Global Agricultural Mechanization Trends 2025: Automation and Intelligence as the Driving Force

In 2025, global agriculture is at a crossroads. Driven by increasing food demand, labor shortages, climate variability, and a growing need for sustainable production, the sector is rapidly transitioning from traditional mechanization toward advanced automation and intelligent systems. For manufacturers, exporters, and stakeholders—especially those operating in China, a leading supplier of agricultural machinery—this transformation presents both significant opportunities and specific challenges. This in-depth analysis explores the technological, economic, and regional trends shaping agricultural mechanization in 2025, highlights key technologies, and offers practical insights for exporters seeking to expand in international markets.

1. The evolution from mechanization to smart automation

Mechanization historically meant replacing manual labor with tools—tractors, combine harvesters, and simple implements. By 2025, mechanization has evolved into an interconnected set of intelligent systems. The emphasis has moved from pure power and scale to autonomy, data awareness, and precision. Today’s modern farms combine autonomous vehicles, remote sensing, robotic harvesters, and cloud-based analytics to optimize inputs, reduce waste, and increase yields.

This shift is driven by three converging forces: technological maturity (AI, sensors, connectivity), economic pressures (rising wages, shrinking labor pools), and policy incentives (sustainability targets and food security programs). The result is machinery that not only performs tasks but also senses, learns, and adapts to field conditions in real time.

2. Key technologies shaping 2025

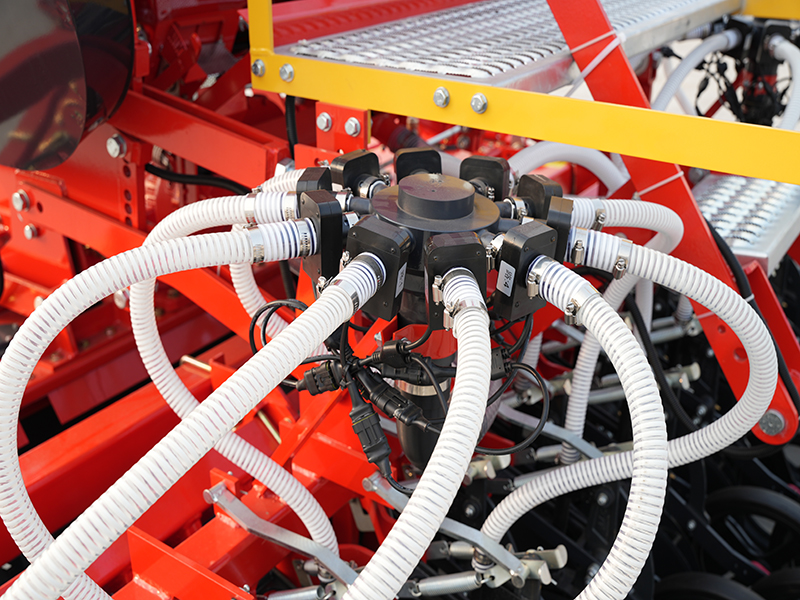

Autonomous tractors and robotic platforms — Equipped with GNSS, LiDAR or camera-based perception, and AI navigation, these platforms can perform plowing, seeding, and precision spraying with minimal human oversight.

Agricultural drones and UAVs — From multispectral scouting to spray delivery, drones accelerate decision making and reduce input costs through targeted interventions.

AI-powered harvesters and picking robots — Advanced vision systems detect ripeness and gently harvest delicate crops, improving quality and reducing losses.

Smart irrigation and fertigation — IoT sensors and edge controllers manage water and nutrient delivery based on soil moisture and crop needs, maximizing efficiency.

Big data and cloud platforms — Aggregated weather, soil, and yield data feed analytical models that optimize farm plans and machinery performance across seasons.

3. Regional dynamics and market demand

Adoption patterns vary by region. North America and Northern Europe lead in high-investment automation: fully autonomous tractors and robotic harvesters are increasingly commercialized. China, meanwhile, is rapidly scaling both compact intelligent implements for smallholder farms and larger autonomous systems for commercial operations. In regions such as Southeast Asia, Africa, and Latin America, demand focuses on cost-effective, modular solutions that combine mechanization with basic smart features.

For exporters, understanding regional farm sizes, crop types, labor economics, and regulatory standards is essential. Successful Chinese exporters in 2025 combine competitive pricing with localization services—training, spare parts logistics, and software adaptation to local languages and regulations.

4. Business models and commercialization

New business models accelerate adoption. Equipment-as-a-Service (EaaS), leasing, and cooperative ownership schemes allow smallholders to access high-tech machinery without heavy upfront capital. Subscription models for data services, remote diagnostics, and predictive maintenance help manufacturers secure recurring revenue while ensuring machines perform at peak efficiency.

Exporters should explore partnerships with local dealers and ag-tech platforms to bundle hardware, connectivity, and services. Training and after-sales support are often decisive purchase factors in emerging markets.

5. Sustainability, efficiency, and resilience

Intelligent mechanization directly contributes to sustainability goals. Precision application of nutrients and pesticides reduces runoff and emissions; smart irrigation conserves water; and AI-guided scheduling minimizes fuel use. Mechanized systems also improve resilience by enabling rapid response to weather events and labor shortages.

Governments and multilateral programs increasingly support mechanization that demonstrates environmental benefits. Manufacturers that can provide verified metrics—water saved, chemical usage reduced, yield improvements—gain market advantages when bidding for public or donor-funded projects.

6. Challenges and barriers

Initial capital and financing constraints for smallholders.

Connectivity gaps in rural areas limiting real-time data services.

Regulatory hurdles and safety standards that differ across export markets.

Need for farmer training and local technical support networks.

Addressing these barriers requires multi-stakeholder cooperation—manufacturers, governments, NGOs, and finance institutions—to design financing, training, and infrastructure programs that match local needs.

7. Practical tips for exporters (especially Chinese manufacturers)

Localize product configurations — Offer models adapted to local crops, field sizes, and fuel types.

Build after-sales networks — Spare parts, service centers, and remote diagnostics reduce downtime for buyers.

Offer flexible financing — Leasing, microfinance, and EaaS lower adoption barriers.

Provide training and digital manuals — Mobile-friendly guides, videos, and local-language support accelerate adoption.

Measure and report impact — Collect data on efficiency gains and sustainability outcomes for procurement and funding opportunities.

8. Frequently Asked Questions (Q&A)

Q1: What is the main difference between mechanization in 2000 and 2025?

A1: The key difference is data and autonomy. In 2000, mechanization replaced manual labor with powered machines. In 2025, machines are increasingly autonomous and data-driven, making decisions based on sensors, models, and connectivity.

Q2: Can smallholders benefit from automation?

A2: Yes. Through shared ownership, leasing, and service models, smallholders can access precision tools and improve productivity without the need for large capital outlays.

Q3: How important is connectivity for smart agricultural machinery?

A3: Connectivity is very important for cloud analytics, remote diagnostics, and real-time control. However, many systems are designed to operate offline and sync when connectivity is available.

Q4: Will automation reduce farm jobs?

A4: Automation tends to shift labor from repetitive manual tasks to higher-skilled roles—machine operation, maintenance, and data analysis—creating new job opportunities while reducing labor shortages.

Q5: What should exporters highlight when approaching new markets?

A5: Emphasize reliability, total cost of ownership, local support, and proven performance metrics. Demonstrations and pilot projects can build trust quickly.

9. Outlook to 2030

By 2030, expect integrated farm ecosystems where autonomous machinery, drones, sensors, and decision-support platforms operate in concert. Climate-adaptive algorithms will recommend crop varieties and schedules, while circular approaches to nutrients and water management will be standard. Manufacturers that invest in interoperability, open data standards, and local partnerships will be best positioned for long-term growth.

Conclusion

Automation and intelligence are the defining trends for agricultural mechanization in 2025. For Chinese manufacturers and exporters, success hinges on delivering not only cost-competitive hardware but also software, services, and localized support. By focusing on scalable technology, flexible business models, and measurable sustainability outcomes, exporters can capture growing demand across diverse global markets.

5. Get Your Personalized Solution Now

→ Call the selection hotline: +86 158 5359 8030 (also supports accessory customization inquiries).